how much does the uk raise in taxes

Sometimes the bonus that you earn may raise the level of your. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds.

Pin On The Truth Will Set You Free

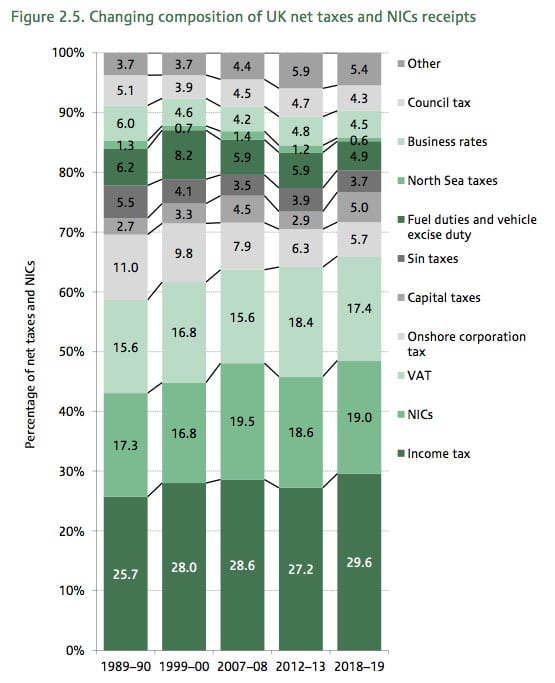

The UK raised 35 of national income in tax in 201819.

. Whats changing in 202223. Incomes below 12750 in the UK are not taxed. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

UK tax revenues were equivalent to 33 of GDP in 2019. However inequality in the UK has increased since 1980. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system.

By 2025 26 billion people will have access to. In 197879 only 11 of income tax receipts were paid by the top 1 of taxpayers. If you get a bonus of 3000 you will still be paying 20 tax and 12 national insurance on this as well.

Increasing IPT would raise 430 million every year for the next three years if introduced in April according to ONS estimates. In 202021 income tax receipts in the United Kingdom amounted to 195 billion British pounds which when compared with 200001 was a net increase of 90. How much does the UK raise in tax compared to other countries.

In line with inflation there will be an increase in allowances and the basic rate limit. Growing income inequality and policy change. Income tax was announced in Britain by William Pitt the Youngerin his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in.

Income tax receipts in the UK 2000-2021. How do tax brackets work in the UK. However from July 2022 the point at which employees start paying NI will increase to 12570.

Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m. From 168 billion in 202122 to 6 billion in 202223. The change since the early 1990s Figure 4 is a continuation of a much longer-term trend.

Successive Governments have used this mechanism to raise additional funds since the tax was introduced in 1994. With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty.

The richest 10 pay over 30000 in tax mostly direct income tax. One of the most famous examples of a windfall tax in the UK was one announced by then-chancellor Gordon Brown in 1997 when the privatised utilities were hit for around 5bn to pay for New Labour. A basic tax rate of 20 applies to everyone who earns between 12501 and 50000.

The share of income tax paid by the top 1 has increased from 25 in 201011. Ben Tippet is a. This represented a net.

The countries that raise. As they continue to rise between 12571 to 50270 the applied tax rate is 20 per cent. This means that high incomes and larger bonuses increase the tax deductions.

From 229 in total income taxes it is anticipated that receipts will increase. From 6 April 2022 Class 1 and Class 4 national insurance contributions are set to increase by 125 percentage points for anyone earning above the primary threshold of 9880. The personal allowance tax-free income in 20202021 is the same as last year at 12500.

They receive around 2000 in benefits. This is effectively a tax rise. From 5 in 2010 to 12 in 2017.

The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19. PAYE tax rates and thresholds. This upper limit is 79 higher than it was in 20182019 46351.

That would be an extra 91000 in tax revenue per person. There are two important sources of this change. Much of the revenue initially.

VAT is one of the largest sources of tax revenue for the government bringing in 132bn in 2018-19. England and Northern Ireland. Similarly as taxes rise from 50271 to 150000 the applicable tax rate is 40 per cent.

English and Northern Irish basic tax. Overall the average household pays 12000 in tax and receives 5000 in benefits. More recently the rate has risen far faster.

A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century. You do not get a. This means that if you earn 30000 a year and are classified as a basic rate taxpayer you will be paying 20 tax and 12 national insurance on incomes in excess of 12570.

This is 55 higher than it was in 20182019 11851 and is set to increase to 13030 in 20212022. The table below shows the national insurance rates for the 202223 tax year. You can also see the rates and bands without the Personal Allowance.

But receive over 5000 in tax credits and benefits. However rises in the UK sales tax cannot be ruled out at some point down the line. From April 2022 anybody earning more than 9880 a year will pay 125p more in the pound.

Figure 1 shows that tax as a share of national income has fluctuated between around 30 and 35 of national income since the end of the second world war and been rising since the early 1990s.

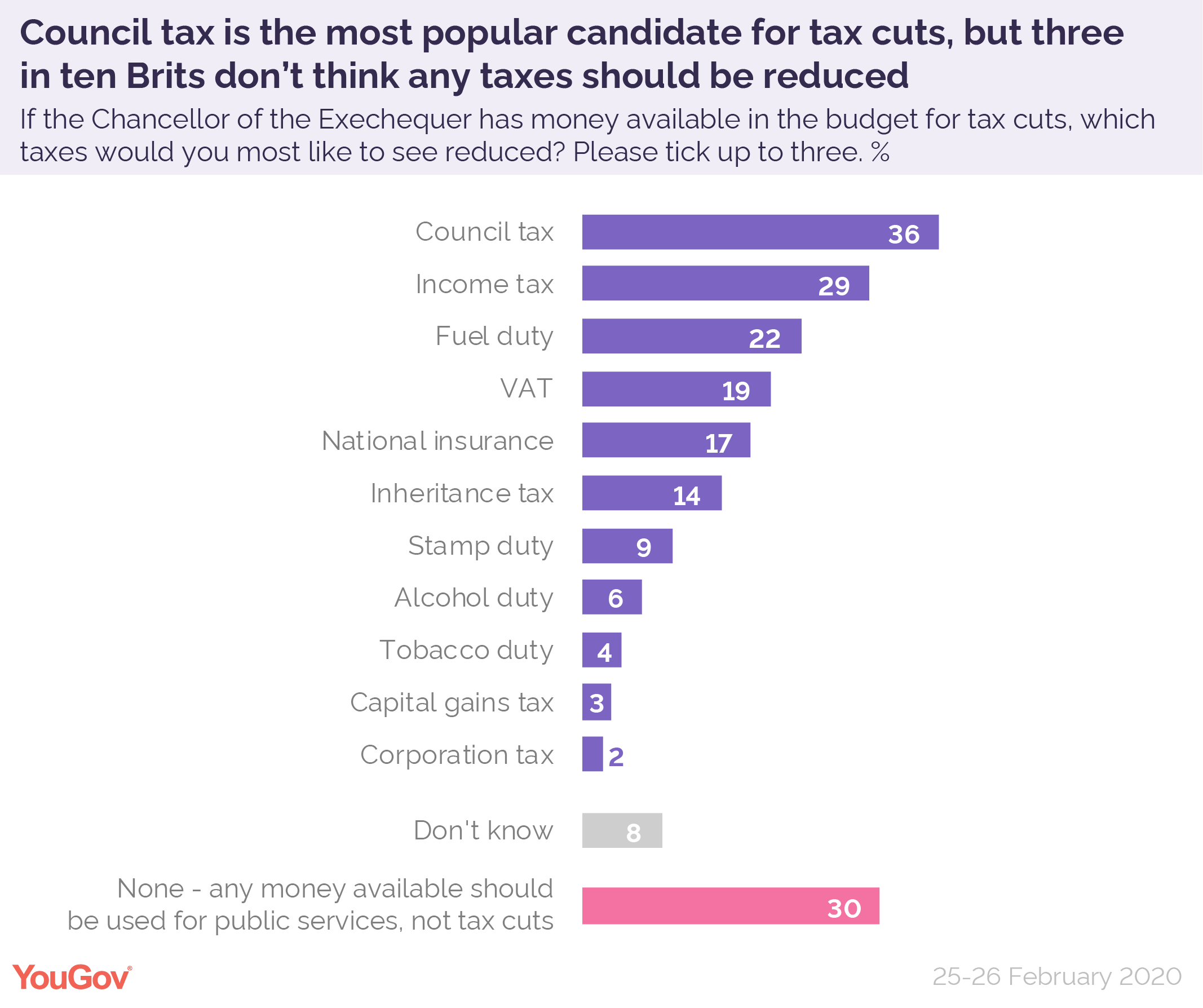

Budget 2020 What Tax Changes Would Be Popular Yougov

Richard Burgon Mp On Twitter Richard Investing Twitter

Types Of Taxes Board Game Teks 5 10a Types Of Taxes Teks Online Programs

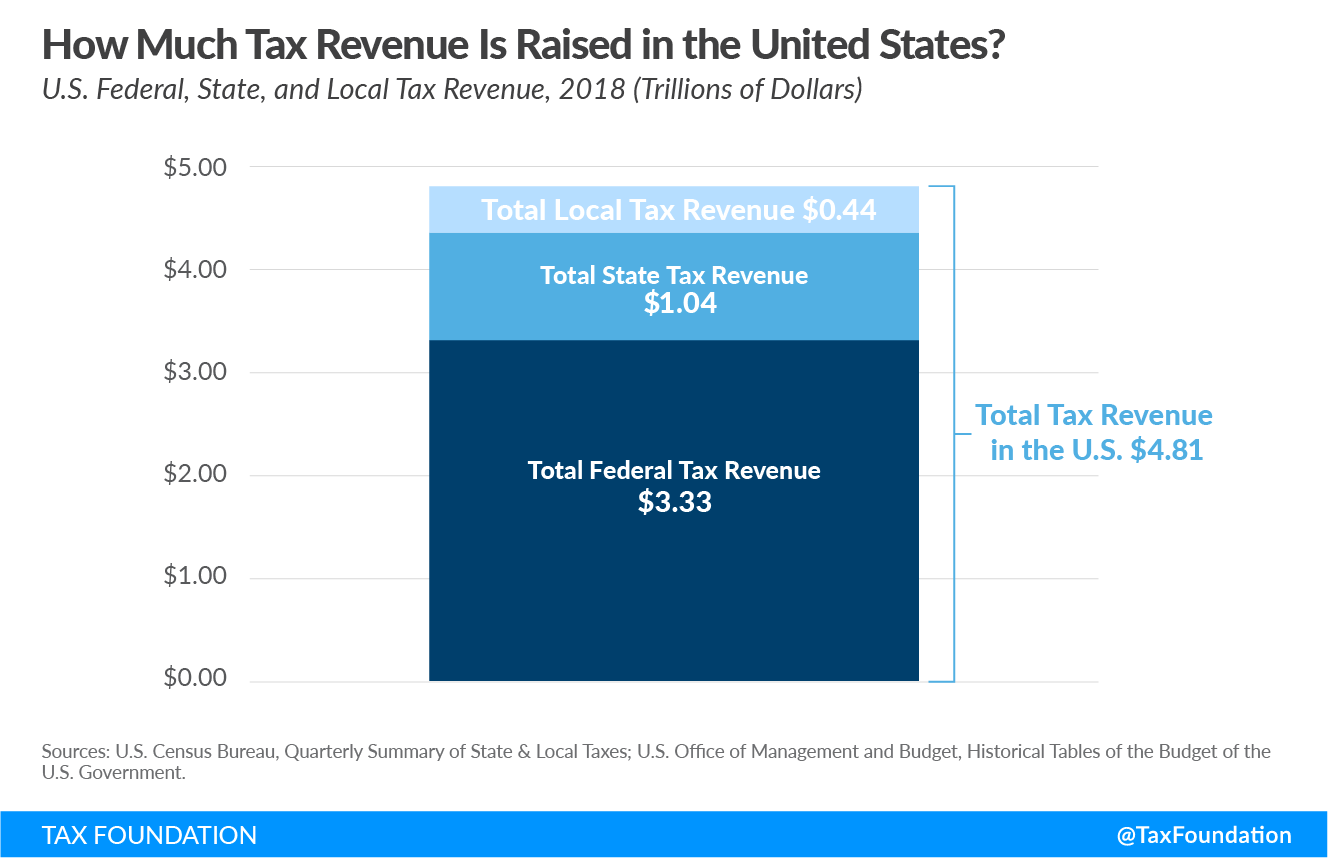

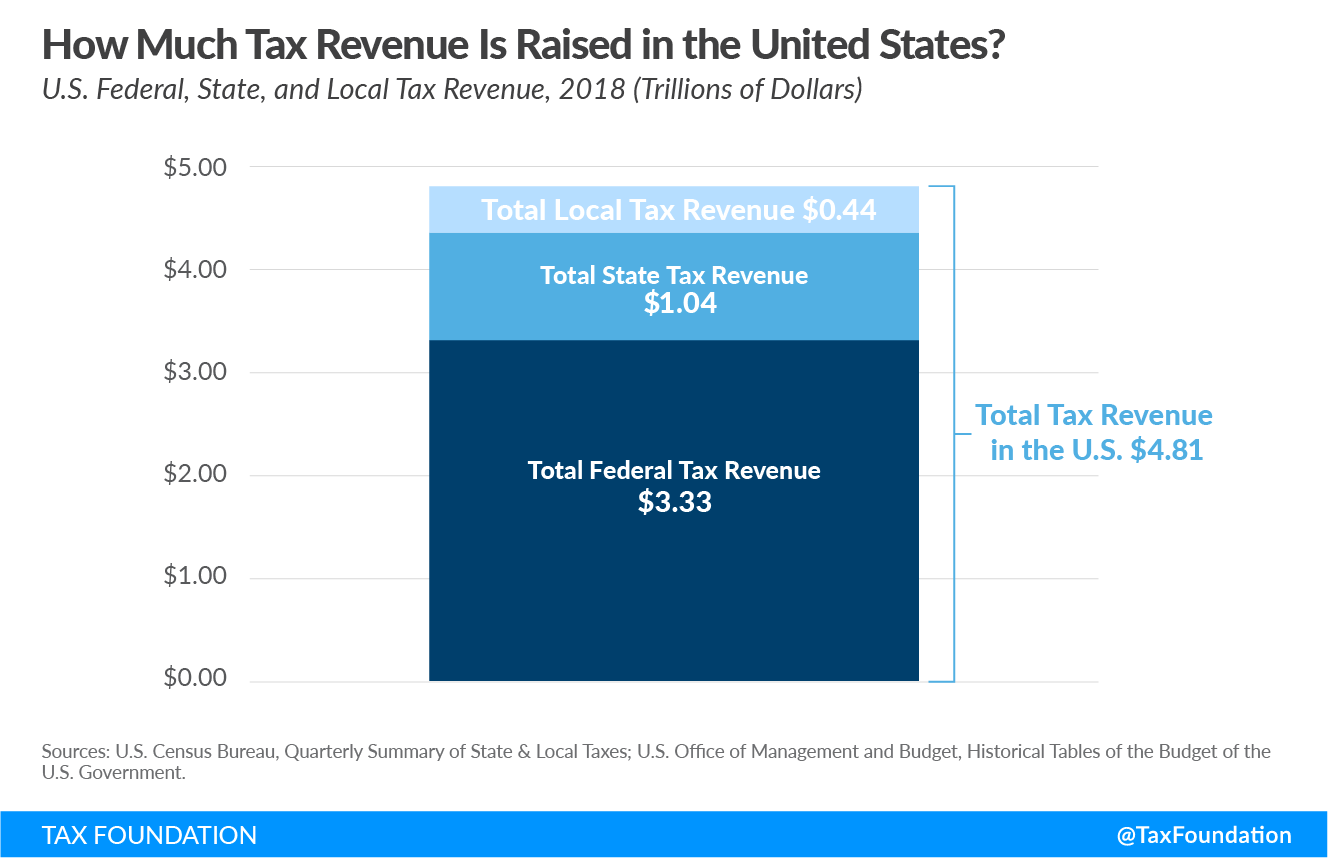

Government Revenue Taxes Are The Price We Pay For Government

Government Revenue Taxes Are The Price We Pay For Government

Britain Hey Colony So We Re Gonna Raise Your Taxes By A Bit You Okay America How Bout You Lick These History Memes History Jokes Stupid Funny Memes

Know Your Worth Then Add Tax Business Woman Quotes Entrepreneur Quotes Women Create Quotes

Gifting Cottage To My Son Will Cost Me 46 000 In Tax How To Raise Money Inheritance Tax Paying Taxes

Types Of Tax In Uk Economics Help

Government Revenue Taxes Are The Price We Pay For Government

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 5 D Income Tax Online Taxes Filing Taxes

Uk Government Revenue Sources 2022 Statista

Government Revenue Taxes Are The Price We Pay For Government

Boxed Is Taking A Stand Against Pink Tax An Upcharge On Women S Products Including Razors And Deodorant That Is Not Applied To T Pink Tax Tampon Tax Thinkpink

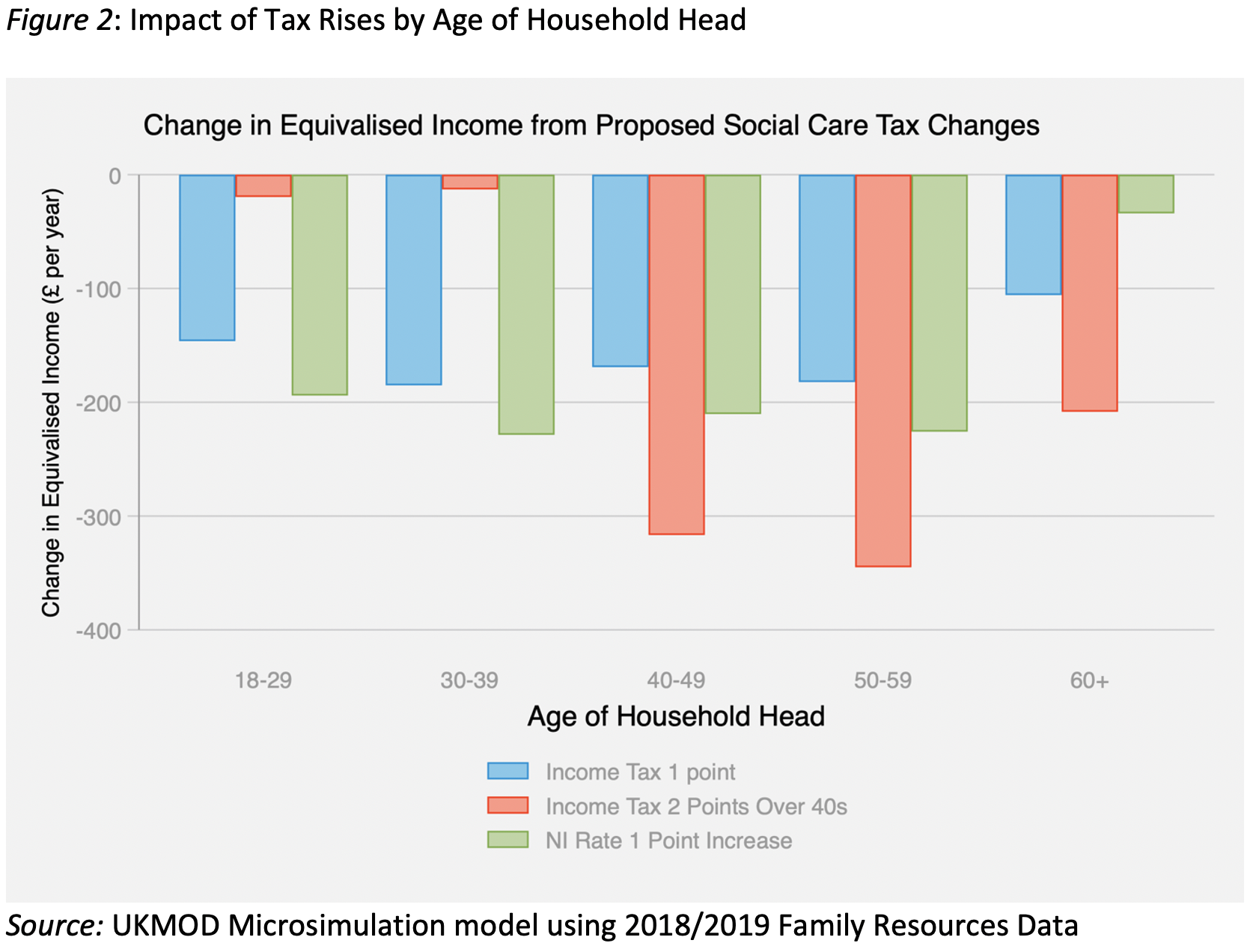

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

How To Raise A Proper British Child In 20 Steps Taxes Humor Accounting Humor Funny Quotes